Sponsored Listings:

If you’re travelling to a foreign country it’s likely you’ll need to pay for things in a different currency, which means either picking up cash before you go or using your debit/credit card abroad.

Fortunately apps and technologies are improving the way we handle our money, with new FinTech companies trying to make our lives easier. WeSwap is a service that lets you change money into foreign currency by swapping with other people. Instead of going to the bank, you’re swapping money with real people in other countries directly. There’s no middle man, which means the cost of your currency exchange is meant to be cheaper.

How does it work?

I signed up for a WeSwap account to see how the whole thing worked. To begin with you simply need to sign up for an account, then WeSwap will mail you a prepaid MasterCard credit card to your chosen address within 3-5 days. Using the app or website you then pay the amount of money you wish to load – maximum £3,000 (or currency equivalent) in one transaction. This can be done by bank transfer or debit card payment and there is no fee for loading you card.

Once you’ve done that, all you need to do is tell WeSwap what currency you need and when you’d like to do the exchange.

You can use your card free online and in shops and restaurants – basically anywhere you see a MasterCard logo. For free cash withdrawals you need to take out at least £200 from an ATM – anything under that and you’ll have to pay a £1.50 charge. For each day you’re allowed a maximum limit of 10 transactions and 2 cash withdrawals, so you’d have to make sure you stick to those limits. Maximum cash withdrawal from an ATM is £500 (or equivalent) per day.

Will it save me money?

With WeSwap you’ll be charged a fee for changing the money, but the rate varies according to when you need it. If you need it right away you’ll be charged more but if you can wait 3 or 7 days you’ll be charged less.

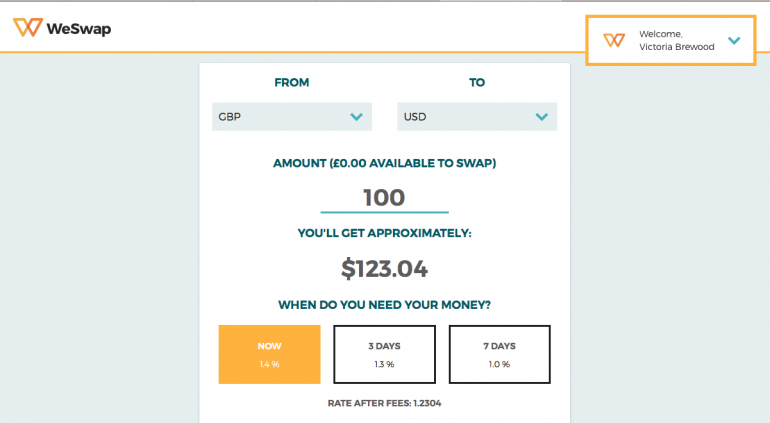

I’m currently travelling in the USA so I decided to take a look at the exchange rate from GBP to USD.

£100 would get me $123.04.

If I wanted it now I’d be charged 1.4%, if I waited 3 days I’d be charged 1.3% and if I could wait 7 days then I’d be charged 1.0%.

The exchange rate, including fees, was 1.2304.

This was better than elsewhere online. With Post Office the rate was 1.1917, meaning £100.07 would get me $120 USD, plus I had to make a minimum order of £400.

With Thomas Cook the rate was 1.2096 meaning £100 would get me $120.96 on their prepaid card.

Looking at these stats the WeSwap card clearly has a better exchange rate, even with the fees. There is also a way to waive the fees too – if you bring 5 friends to WeSwap will give you 7-day swaps for free – for life! WeSwap also runs a referral program so you’ll earn £5 when your friends sign up, and they’ll get £5 free too!

What if I don’t use the currency?

If you’re wondering what will happen to the money you don’t use – WeSwap say the money remains safely on your card, so you can swap it to another currency anytime, or swap it back and use it at home at no extra cost.

When using the card in your home currency you can withdraw maximum amount of £200 (or equivalent) per 7 days and you can spend maximum amount of £150 (or equivalent) per 7 days.

Currencies

WeSwap works with the following currencies:

- GBP – Pound Sterling

- EUR – Euro

- DKK – Danish Krone

- NOK – Norwegian Krona

- SEK – Swedish Krona

- USD – United States Dollar

- CHF – Swiss Franc

- AUD – Australian Dollar

- CAD – Canadian Dollar

- HUF – Hungarian Forint

- HKD – Hong Kong Dollar

- JPY – Japanese Yen

- NZD – New Zealand Dollar

- PLN – Polish Zloty

- SGD – Singapore Dollar

- ZAR – South African Rand

- TRY – Turkish Lira

- ILS – Israeli Shekel

My Verdict

WeSwap is designed to provide cheaper, fairer rates for all, which is a definitely welcome change. It will only work with certain currencies though, so you’ll need to check if your destination is covered in the list. You do need to read the full terms and conditions so you are aware of the fees associated with the card. If you don’t use your card for more than a year, you’ll be charged £2 a month as long as the account remains inactive. I’d definitely use it though as an alternative to changing money at a money exchange or using my bank card abroad. Every time I use my debit card I am charged transaction fees, so having a prepaid card in a different currency is really useful.

The post WeSwap Review: Swap Foreign Currency with Other Travellers appeared first on Pommie Travels.

Source: pommietravels.com