Sponsored Listings:

December brought the first year-over-year bump in domestic monthly airline ticket prices in almost two years.

Analysts, however, remained divided last week over whether the increase will be the start of a new trend driven by higher fuel and labor costs or merely a blip.

“Things may change with a new administration and new labor agreements,” said Chuck Thackston, managing director of enterprise information for ARC. “Hard to predict how those will impact average ticket prices, but demand continues to be strong, and competition is good, so it is really a good time to be traveling by air.”

Airfares rose 1.9% in December, according to data released Jan. 18 by the Bureau of Labor Statistics. That figure closely parallels data provided by ARC last week that showed that domestic airfares increased by 2% year over year in December, the first such jump since March 2015.

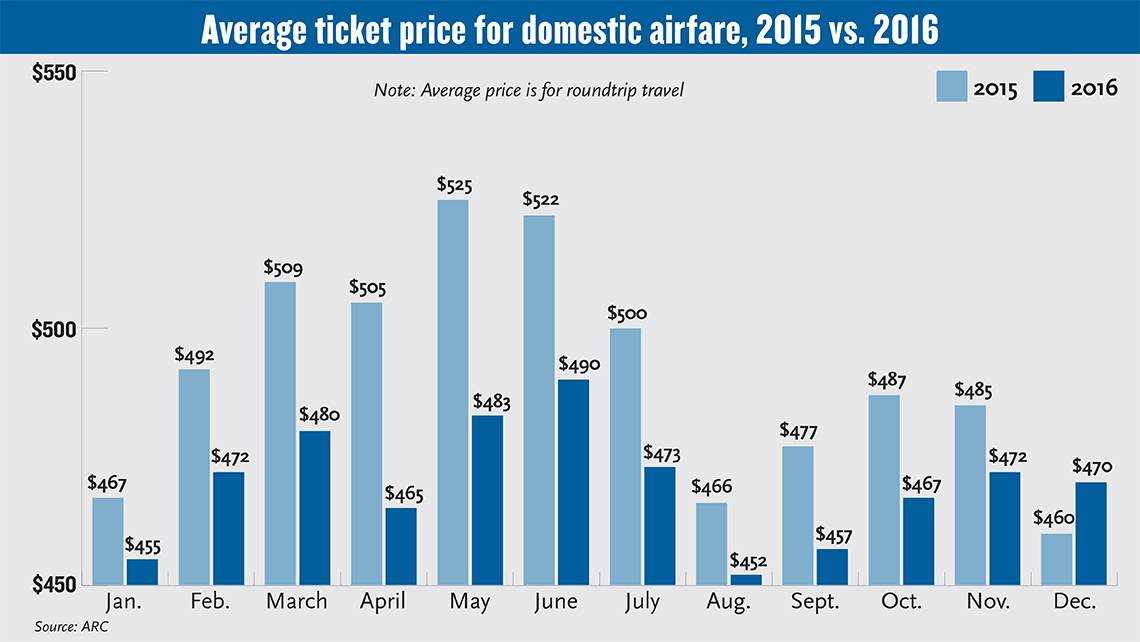

The cost of a domestic roundtrip ticket averaged $470 last month, up from $460 a year earlier. The data incorporates tickets bought in all fare classes.

December’s increase was a sharp change of direction for domestic ticket prices, which until then had dropped on a year-over-year basis by at least 2.7% in each month of 2016. The trend peaked in April and May, when prices were lower than in 2015 by 7.9% and 8%, respectively.

For the year, ticket prices were down more than 4%, Thackston said, following a drop of slightly more than 3% in 2015.

Some analysts are predicting a different outcome this year. Cheap fuel prices buoyed record U.S. airline profits in 2015 and 2016. But the cost of crude oil had jumped from a low of $26 per barrel last February to $51 as of last week.

Meanwhile, Cowen Group airline stock analyst Helane Becker said in a recent Bloomberg television interview that airlines have split their profits roughly in thirds, with one portion going back to investors, a second part going to employees in the form of wage increases and the final portion to consumers in the form of cheaper tickets. Becker predicted airlines could take about half of the consumers’ piece back in fare increases.

“We’re thinking about midyear some of that pricing power comes back,” she told Bloomberg.

Becker is not alone in predicting fare increases. In an analysis this month, Patrick Surry, chief data analyst for Hopper, an app that tracks airfares with an eye toward price-conscious travelers, wrote that he expects airfares to track higher for the first six months of the year. In June, at the end of Hopper’s forecast window, Surry projects ticket prices will be on par with the prices of June 2015 and approximately 8% higher than they were last June.

Along with fuel costs, capacity discipline and increased labor costs could help airlines regain pricing power as 2017 plays out.

Last year, the Big Four U.S. airlines — American, United, Southwest and Delta — entered into a total of 15 labor agreements. Included among those deals for Delta, United and Southwest were collective bargaining agreements with their pilots.

The new contracts are already having a substantial impact on bottom lines.

In its fourth-quarter earnings call last week, United reported a 5.9% year-over-year increase in labor costs. Meanwhile, the 18% pay increase that Delta agreed to as part of a December deal with its pilots brought labor costs up by $475 million in the fourth quarter, including $380 million in pay that was retroactive to Jan. 1.

Faced with declining margins in a higher-cost environment, the major carriers are responding by slowing growth.

Delta is expecting its capacity to drop by as much as 1% this quarter, while United is estimating growth of just 1% to 2% this year.

Meanwhile, Southwest is estimating capacity growth of 3.3% in 2017, well below the 5% to 6% annual growth it forecasted in October.

Still, the legacy U.S. carriers can expect to see their power to raise prices limited in the year ahead by much faster growth among the ultralow-cost carriers. Spirit, for example, said last week that it expects to increase capacity by 18.5% this year. And Allegiant’s guidance anticipates a year-over-year increase of 10% to 14% in the first quarter.

The influence of the low-cost carriers is a prime reason why George Hobica, president of Airfarewatchdog.com, said he does not expect it will cost more to fly in 2017.

“On competitive routes, you are going to see continued low, low fares,” Hobica predicted. He added that what price increases the market does see would likely be directed more toward business travelers.

“The vast majority of travel is discretionary,” Hobica said.

Surry largely agreed, and said that while he is forecasting airfares to rise in aggregate, there is plenty of nuance when viewed at a route-to-route level.

“It seems like the cost increases get passed on more quickly in the less-competitive markets,” Surry said. “Routes like New York-San Francisco get serviced by a lot of carriers, so you don’t usually see the prices rise there.”

Sourse: travelweekly.com