Sponsored Listings:

JetBlue is popular with customers for its free high-speed WiFi and live television, its Mint business class and its U.S. airline industry-leading legroom in economy class. But in the key operational measure of being on time, JetBlue ranked second to last among U.S. carriers in 2017.

What’s more, with last-place finisher Virgin America being subsumed by Alaska Airlines this month, early indications are that JetBlue could take over its spot at the bottom of the pile.

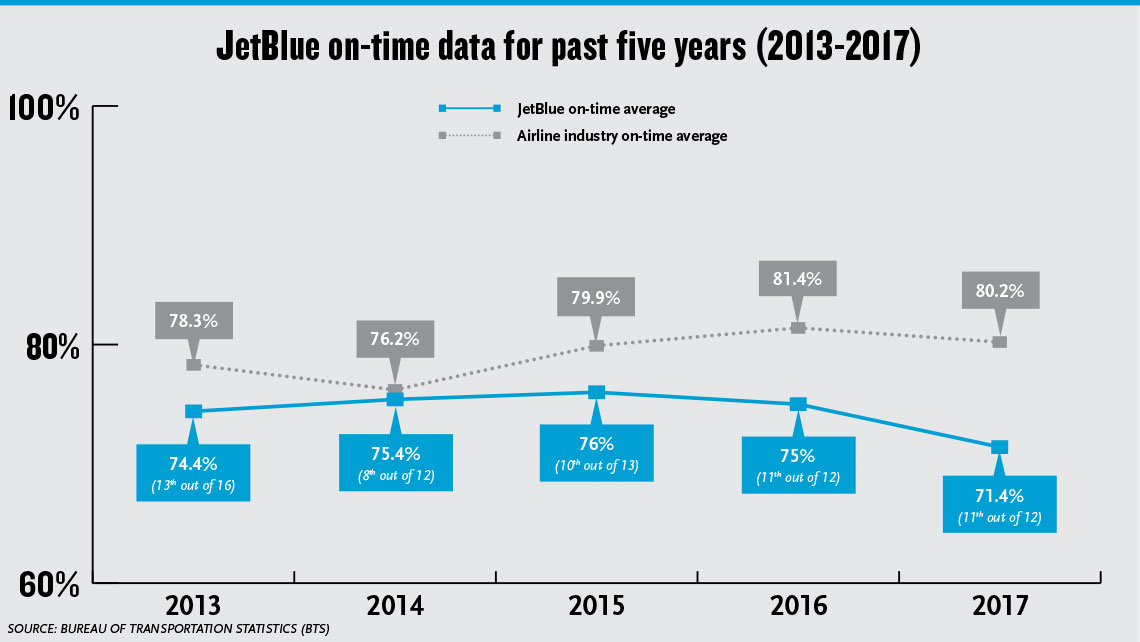

Last year, New York’s hometown airline recorded an on-time percentage of 71.4%, according to Bureau of Transportation Statistics (BTS) data. That compared with the industry average of 80.2% and with an on-time percentage of 70% for Virgin America, where operations were going through a transition following its acquisition in December 2016 by Alaska.

This January, JetBlue’s on-time percentage, defined by the DOT as the portion of flights that arrive within 15 minutes of schedule, plunged to 65.8%, worst among the 18 airlines that the BTS is now tracking.

Struggles with being on time aren’t new for the carrier. JetBlue’s on-time percentage has been lower than the industry average since 2005, and in 2016, the carrier placed 11th out of 12 airlines in BTS reports, besting only Spirit. Still, 2017’s on-time performance of 71.4% was the airline’s lowest since 2007.

JetBlue declined an interview request for this report, but in a statement, spokesman Morgan Johnston blamed the regional market, asserting that 70% of the carrier’s schedule touches the congested Northeast corridor.

“In New York and Boston, we still hold our own against competitors,” he said. “However, other airlines have major hubs in less congested markets, and flights from those hubs offset delays or cancellations they have in [New York], so [air traffic control] initiatives in the Northeast impact JetBlue more than other airlines.”

His statement was similar to public comments the carrier has made for a while. In terms of the number of arrivals, Boston and New York are JetBlue’s largest focus cities, with each topping its third-most frequented market, Fort Lauderdale, by at least 60% in January.

Arguing that it would lead to quicker implementation of the GPS-based NextGen air traffic control system, JetBlue was a strong advocate of the recently failed effort by Rep. Bill Shuster, R-Pa., and the trade organization Airlines for America to transfer control of U.S. air traffic control from the FAA to a private, nonprofit entity governed by a board of stakeholders, including airlines.

On earnings calls, CEO Robin Hayes has said that JetBlue put an on-time performance initiative in place in late 2106, though he has provided few specifics about what the initiative entails.

In the email, Johnston said that in an effort to ease controllable delays, the carrier has recently changed boarding procedures and added additional time for aircraft turnaround on strategic flights, for example red-eyes, so that the morning schedule can start strong.

Despite the undeniable drag that JetBlue’s Northeast operational base has on on-time performance, data suggests there are other problems as well. Even within Boston and New York JFK, for example, JetBlue lags most rivals’ on-time performance. Of the nine airlines whose on-time performance at Boston was tracked by the BTS in 2017, JetBlue fared the worst, at 72.2%.

At JFK, JetBlue fared the worst of the six airlines tracked by the BTS. In Fort Lauderdale, JetBlue’s largest operational base outside the Northeast, its on-time percentage of 70% was the worst of the 10 airlines for which the BTS kept data.

JetBlue’s particularly large troubles in January, the last month for which the BTS had released data as of press time, were caused in part by broader delays within the national aviation system as well as by inclement weather, including the early-January blizzard.

But 10.1% of JetBlue’s flights in January were delayed due to its own operational problems, the most of the 18 airlines the BTS tracked that month and more than double the national average of 4.9%.

Aviation analyst Bob Mann of R.W. Mann and Co. said that for the foreseeable future, JetBlue and other airlines can expect the problems of crowded airspace and airport facilities in the Northeast corridor to get progressively worse.

“The issue,” he said, “is what are you going to do about it?”

Mann said that for a decade, he has unsuccessfully pitched JetBlue on the air traffic flow management software system called Attila, which Delta formerly employed to improve operational efficiency at its Atlanta and Detroit hubs.

Airlines need to help themselves traverse the crowded Northeast network, he said.

“You can wait forever, or you can manage it yourself,” Mann said.

Source: travelweekly.com