Sponsored Listings:

The 50 days of demonitisation have been perhaps most demonising ones in the economic life of the country, since liberalisation. At the heart of it may be the trust deficit of private citizens in the government, due to unreasonably high taxes.

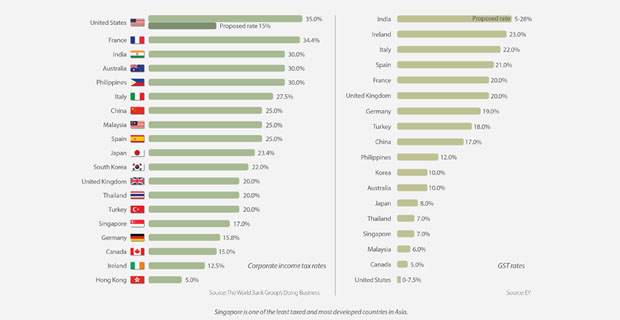

If Singapore and soon, the USA could manage with 15% kind of Income Tax on businesses, why cannot our Government of India?

Some would say smaller portion of Indians than Singaporeans and Americans pay taxes, but that may indeed be due to high tax rates in India. Others may say tax rates of European countries should be our benchmark, as we are supposed to be a Socialist welfare state like them. But where is the welfare one may ask?

Not even drinkable water in the taps, leave alone high-quality free education and civic amenities these as well as Singaporean and American governments provide.

Simply redistribute, some of the pundits would say. Let the higher tax collection be doled out in the jan-dhan accounts. But if private fellows could use the poor (and often illiterate) holders of these accounts for a cut, how would the government protect from abuses by the babus and the State apparatchiks?

Then how can high-taxes be justified? Either way, it may be foolhardy to keep a high tax rate and expect high collection, when the evidence has shown the opposite is the cause and effect Even the argument for a cashless or less-cash economy completely disregards the high-cost of plastic often subsidised by the poor who can only afford to pay in cash! The other problem is the chor-police game it wants to build on as a principle.

Now let’s address the question: isn’t it better to do something about so called black money than nothing? Of course it is better. But it better be logical and effective?

Abolish or reduce business Income Tax to 15%. Let the money parked abroad be brought back in India with a penalty of 10% (as in Trump tax plan has it).

Make sure GST on services, including Tourism, if not on everything, is not more than a single digit. (Singapore’s GST on everything is 7%). Give some kind of a staggered tax credit or refund to those who have paid high-income tax in the recent past. Where will the money come for running the country then?

That is the magic of lower taxes. Expect the collection to rise as a result of the tax-cut. Expect the private citizen to fall in line and pay the reduced taxes, as the incentive in avoidance would have gone.

Reign-in the corrupt tax administration. Declare a war on tax-terror rather than on poor tax payers! (Every citizen pays tax, even while buying a matchbox!)

Make a just, simple and trust-based tax compliance system and then expect the citizens to be patriotic. Walk the talk, be a small government in-deed (not just a smaller cabinet of Ministers!).

If you keep saying it is not the business of governments to run businesses, sell the banks. Sell all the public sector enterprises. Give voluntary retirement to the redundant and sack the corrupt babus. These measures will reduce the government expenditure and unproductive bleeding.

Do as Singapore does.

If Donald J Trump can learn from Singapore, why can’t we?

Source: travelnewsdigest.in