Sponsored Listings:

Frequent flyer point giveaways, free checked bags and fast tracks to elite loyalty status are just some of the perks that come with various airline-branded credit cards.

But an offer rolled out by Southwest Airlines in January turned heads among industry insiders.

The Southwest Rapid Rewards Plus Credit Card seeks to entice new cardholders with the opportunity to designate a companion to fly with them for free for the remainder of 2019 after spending just $4,000 within months after opening the account.

“That’s a crazy generous offer,” said Jay Sorensen, president of the consulting firm IdeaWorksCompany, which produces an annual report on industrywide airline ancillary revenue, including proceeds from co-branded credit cards.

The offer is all the more extraordinary, said Samuel Engel, an aviation industry analyst for the consulting firm ICF, because Southwest has traditionally been very disciplined about maintaining the integrity of its annual Companion Pass loyalty perk, which customers otherwise must earn by accruing 110,000 points in a year through a combination of flights and co-branded credit card purchases.

“I think there is an arms race going on,” Engel said.

Indeed, airlines have much to fight over in the lucrative credit card market. The carriers earn income from the co-branded cards by selling reward miles or points to the issuing bank. So, for example, Citibank will purchase American AAdvantage points to award to new holders of the companies’ co-branded credit card. Similarly, banks purchase the airline loyalty points that they award cardholders for making purchases.

It’s a winning scenario for the credit card providers, which use the co-branding to entice customers and then fund the point purchases out of transaction fees they earn from merchants. It’s also a winning scenario for airlines.

Last November, IdeaWorksCompany estimated that U.S. airlines in 2018 would make approximately $15.6 billion in combined revenue from the sale of credit card points and from commissions from sales of partner products such as car rentals and travel insurance. Of that $15.6 billion, approximately $14 billion was expected to come from credit card points, Sorensen said.

Some of those point purchases are made directly by the carriers’ loyalty program members or by nonbank partners such as hotels. But about 90% come from credit cards, Sorensen said.

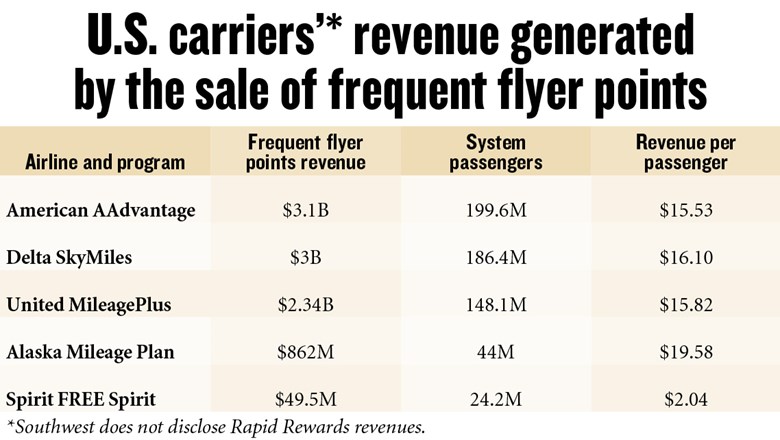

Airlines don’t specifically report credit card revenue, but in 2017, the last year for which full figures are available, American generated $3.1 billion from AAdvantage program points sales, according to IdeaWorksCompany. Delta generated a similar $3 billion, and United earned $2.3 billion.

Southwest does not disclose Rapid Rewards revenue, though IdeaWorksCompany estimates it was $2.44 billion in 2017.

Indications are that those figures are still on the rise. For example, American saw a 9.7% increase in what it calls “other revenue” in 2018, crediting an increase in loyalty revenue for the jump.

Gary Leff of View From the Wing website, a website that closely follows loyalty programs and co-branded credit card offerings, said American offers a perfect example of just how important credit card revenue can be to an airline. In 2018, he said, American laid out more in cost for each seat mile it offered than it took in in passenger revenue per available mile.

The carrier’s total operating income of $2.66 billion last year was less than the profit Leff estimates American made through co-branded credit cards.

“It’s accounting for the entirety of [American’s] profit,” he said.

American spokesman Josh Freed did not dispute that assertion last week, but he noted that the carrier’s credit card business is inextricably linked to its flying.

“Certainly the credit card business is an important part of our revenue,” Freed wrote in an email. “Customers find it valuable because they can redeem miles for travel. You really can’t separate them.”

Engel and Leff agreed that the immense value airlines get from their co-branded credit cards can influence their strategies in a variety of ways.

For example, both said that Southwest’s decision to fly to Hawaii will make the Rapid Rewards program more enticing to flyers. Unlike major U.S. competitors, which fly throughout the world and offer mileage redemption partnerships with international carriers, Southwest doesn’t fly beyond the U.S., Latin America and the Caribbean. But soon people will be able to use Rapid Rewards points to go to Hawaii.

The lucrative nature of credit card partnerships is driving generous sign-up offers, such as Southwest Rapid Rewards Plus. Another current example is a new Delta SkyMiles American Express, from which cardholders will earn 70,000 miles after spending $2,000 during their first three months of membership.

Further driving the competition are cards issued by banks that don’t have airline co-branding but as a result are more flexible than airline cards. Holders of such cards — the Chase Sapphire brand is one example — can often accrue points on the airline of their choice rather than being bound to a specific carrier. And such cards sometimes offer generous point accrual benefits per dollar spent.

To counter such cards, airlines sweeten their co-branded cards with perks that banks can’t offer on their own, such as free checked bags and priority boarding.

Carriers are also taking other steps to entice would-be credit card customers. For example, late in 2017, American began opening up more seats for AAdvantage redemptions.

“This paid off quickly in terms of overall usefulness of the program for members,” Freed said.

Source: travelweekly.com