Sponsored Listings:

Clones of Airbnb and HomeAway aren’t new. At a basic level, it only takes about $1,000 and some basic coding skill to make a copy-cat short-term rental listing platform.

Clones of Airbnb and HomeAway aren’t new. At a basic level, it only takes about $1,000 and some basic coding skill to make a copy-cat short-term rental listing platform.

But to actually have a thriving business, you need to get hosts to list and travelers to book on your site and mobile app. That is no easy trick, of course. Airbnb has 2 million listings, far more than any aspiring competitors except for Tujia and HomeAway.

In fact, it’s easier to create a business that support to hosts and guests that use the major short-term rental platforms, and we’ve named some of those rising stars recently (see, “5 New Travel Startups Defining Short-Term Rental Challenges in 2016.“)

But as Airbnb needs to seek growth via hotel partnerships and incorporating the sale of activities and other travel products, a gap may open up for rivals that target niches in listings and audiences it hasn’t developed, such as corporate travel, design-heavy properties, and properties with exclusive clientele.

In the past, we’ve covered Airbnb alternatives like Villaway, Kid & Coe, and Innclusive. But here’s a fresh set of names aiming to hone their niches.

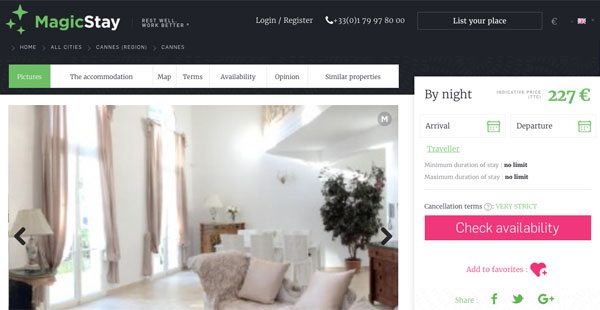

MagicStay is a platform for serviced apartments for business travelers in Europe. Founded three years ago, the Paris-based startup raised 1 million euro last autumn, bringing its total funding to 4 million euro.

The 20-person startup says it offers 100,000 apartments in Europe. Advisors include Charles Petruccelli, the former president of the travel division at the American Express, and Benoît Bassi, President of equity group Bridgepoint in France.

>>SkiftTake: MagicStay is seizing the corporate travel market by making sure all of its inventory can be compliant with corporate travel policy and booking systems. It offers hotel-style services, which can reassure companies who have duty-of-care responsibilities to their employee, and which can appeal to guests eager in turning business trips into bleisure trips.

Favstay short-term rental accommodation booking platform Thailand

FavStay, is both a rental listing service and a company providing housekeeping and other host services for short-term rentals in Southeast Asia. It is supported by 500 TukTuks, the Thailand-focused fund from incubator 500 Startups. It says it is raising its first round of investment.

A year ago, FavStay was launched in Singapore by CEO Suchada Taechotirote, who previously built a thriving lodging business (Pompome.com), and Natavudh Pungcharoenpong, who co-created Ookbee, an online service provider.

>>SkiftTake: FavStay already has more listings in Thailand than Airbnb, by our count. If it can repeat this trick in other Asian nations, as planned, it will give credence to the idea that Asian startups can have a stronger ground game for lodging inventory sign-ups than the global players can.

Afini, a vacation home booking platform based in Singapore, operates on a paid club model. Members pay about $8,900 to join for a chance to stay at its luxury properties, currently numbering 25 and in 12 of Asia’s top destinations. Afini’s executives have backgrounds at luxury property rental companies and membership clubs.

Founded in 2016, Afina controls and manages most of the properties directly and claims to offer them at discount to the market value when compared to similar homes rented by other companies. For instance, it rents a villa in Phang Nga Bay, Thailand, created by architect Jean-Michel Gathy and designer Philippe Starck, which comes with a longtail boat for exploring the local area.

>>SkiftTake: Afini taps into a trend in fast-growing sales of ultra-luxury travel. It banks on exclusivity and high-touch service as its twin appeals. The high price of membership will mean that only a small group of people will be able to stay at these properties, giving guests bragging rights.

Muniao, which means “woodpecker” in Mandarin, is a short-term rental platform in China that says it has 200,000 residences in 400 Chinese cities. In 2015, it raised 60 million yuan, about $9 million at the time. In 2016, Fortune Venture Capital and Plum Ventures participated in an additional wave of undisclosed financing.

The Beijing-based startup deserves notice because of recent market changes. In 2016, short-term rental platform Tujia acquired rival Mayi Duanzu and the lodging-sharing businesses of Ctrip and Qunar, while Airbnb China entered talks to possibly buy Xiaozhu.

>>SkiftTake: Muniao has a steep hill to climb for brand building, listings growth, and user experience enhancements if it wants to be acquired. For context on the competition, see our earlier interview: Airbnb’s China Rival Tujia and the Power of Home-Field Advantage.

BoutiqueHomes is a short-term rental lodging network that is choosy about the types of properties it lists. It only displays architectural and design gems in desirable locations, primarily in Europe and the Americas but also in spots elsewhere. Think, a desert nomad house by architect Rick Joy in Tuscon, Arizona.

>>SkiftTake: The charm that distinguishes a private house from a hotel is its personality, and for design fiends who don’t want to have to sort through pages and pages of search results to find properties worth their time, BoutiqueHomes’s curated list will be a savior. The fees on the typically $1,000-a-night properties are probably enough to keep this as a thriving mom-and-pop business for proprietors Heinz Legler and Veronique Lievre for a long time to come.

For all of our startup coverage, check out our SkiftSeedlings archives, here.

Source: skift.com