Sponsored Listings:

Iceland, a small country nearly 1,000 miles from Continental Europe, was a clear winner in European tourism last year as airline capacity to the country grew and many travelers chose alternative European destinations versus traditional tourism strongholds such as Paris and Brussels.

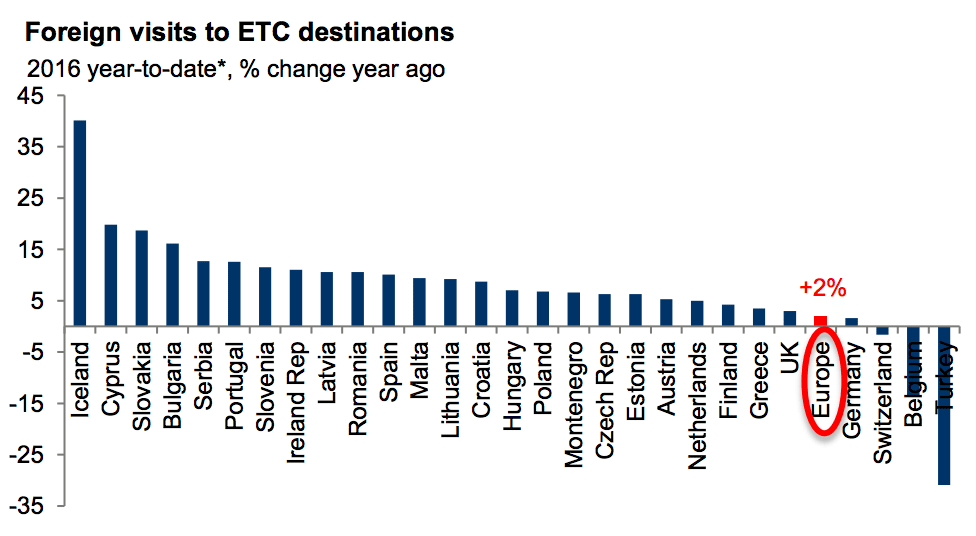

Europe had 620 million international tourist arrivals in 2016, a two percent increase over 2015, and that represents the seventh consecutive year of tourism growth for the continent.

Some 28 out of the 32 European destinations part of a recent report by the European Travel Commission and Tourism Economics reported tourism growth in 2016.

Iceland, for example, had three times more foreign visitors last year (more than one million) than its own population. Iceland’s international arrivals were up 40 percent year-over-year, the steepest foreign tourism growth for any European country.

Important long-haul markets such as the U.S., China, and Japan grew for many Northern and Eastern European destinations while Western European countries had weak or negative growth from these and other markets.

Last year, Skift launched a deep dive on overtourism in Iceland that details the tourism challenges and opportunities for the country. “The continued strength of the U.S. dollar is supporting transatlantic demand evidenced by the growth in arrivals from the U.S.,” the report states. “However, there are some suggestions that accommodation capacity constraints may be starting to bite in Iceland and such growth is not sustainable into the longer-run.”

Lithuania had one of the largest overall increases in Europe for international arrivals in 2016 (about 10 percent) from both European and non-European markets. Coincidentally, the Lithuanian tourism board chief resigned last year after a campaign featured some photos of Finland and Slovakia that the tourism board marketed as photos of Lithuania.

Visitors from large European travel markets such as Germany, France and the UK also increasingly chose Northern European countries. “Growth from these markets is also supported by stable economic conditions in the Eurozone owing to improving labor markets and solid money and credit growth,” the report states.

Security concerns likely tilted travelers’ choices toward off-the-beaten-track destinations. “Several European destinations enjoyed sustained growth from German holidaymakers whose price consciousness continues to attract them towards more affordable destinations,” the report states.

UK outbound travel remained strong in 2016 despite a weaker pound. About one in two European destinations reported double-digit growth from the UK including Spain and Portugal (both up more than 12 percent) and Ireland (up more than 11 percent).

Terrorist attacks across France continue to impact the country as a destination but not as a source market. Most major European destinations reported some growth from France at the end of last year, returning to more typical trends. Iceland, Lithuania and Portugal, for example, had strong arrivals growth and overnight stays from France.

Sweden, the UK, Greece, Belgium and Turkey were the only five of 32 reporting European destinations which saw fewer French arrivals compared to 2015.

Following is more analysis on long-haul visitor market growth for Europe in 2016 and how countries’ international arrivals compare.

Chart 1: Europe had 620 million international visitor arrivals in 2016, a two percent increase from 2015. Iceland’s growth is most notable as its year-over-year visitor growth was 20 times more than that of Europe as a whole.

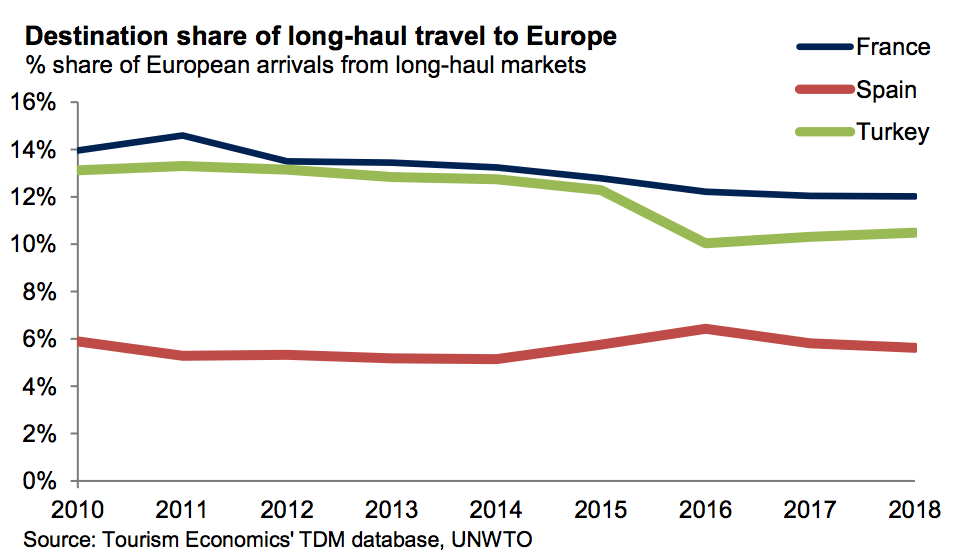

Chart 2: Spain benefited from violence in France and Turkey last year with a larger market share in long-haul arrivals. Albeit, Turkey’s market share is projected to increase slightly this year and in 2018 while Spain’s is expected to fall and France’s isn’t expected to change.

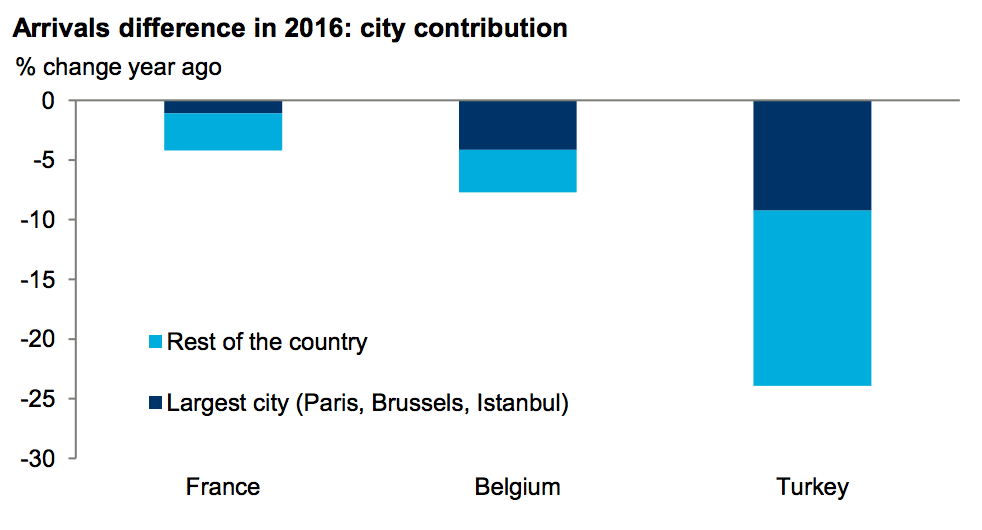

Chart 3: Destinations within a country not directly hit by terrorism can also suffer following a terrorist attack due to perceptions of safety within the country as a whole. Paris suffered a terrorist attack in 2015 and Brussels and Istanbul suffered attacks in 2016. However, Tourism Economics estimates that fewer arrivals in other parts of the country accounted for around half of the overall drop in travel to Belgium as a whole in 2016.

The July 2016 attack in Nice, France has contributed to a perception of increased risk in traveling to the country as a whole, the report states. In Turkey, Istanbul accounts for about two-fifths of country’s fall in arrivals.

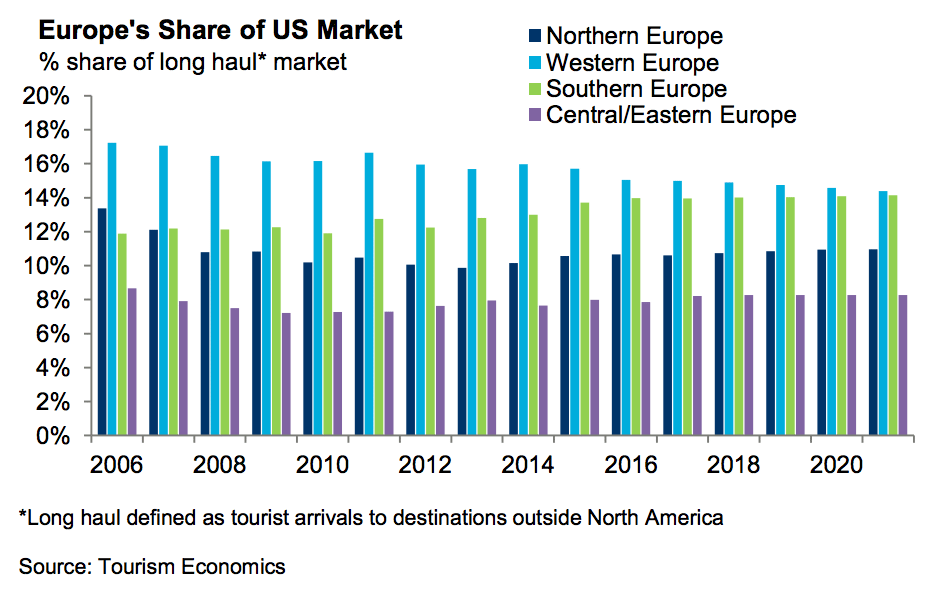

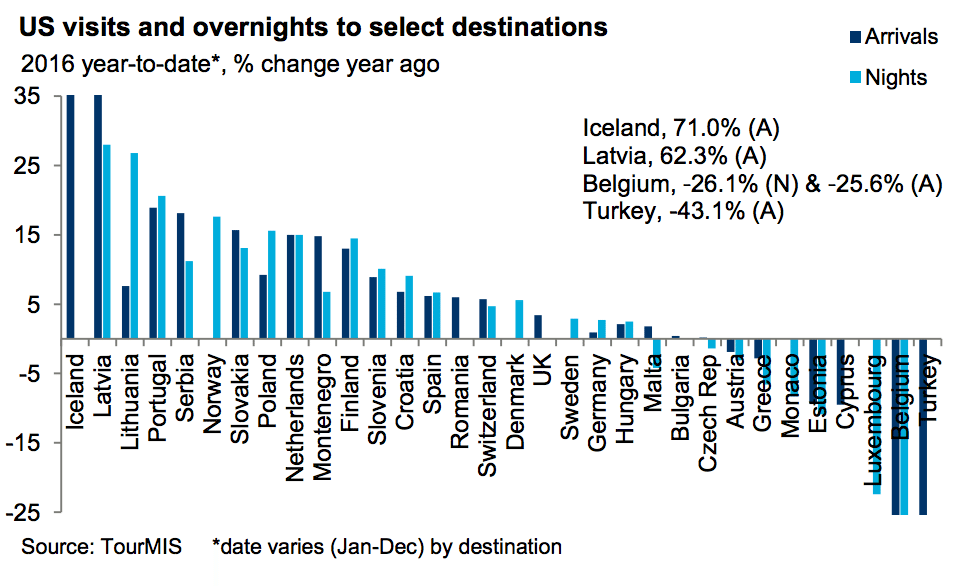

Chart 4: Travel from the U.S. to European destinations hasn’t seen as much blowback compared to other markets.

U.S. arrivals to Western Europe were about 16 percent of Europe’s long-haul market share in 2015, down from about 17 percent in 2015. Southern Europe’s U.S. arrivals, however, were up about one percent from 2015.

Chart 5: Some 24 of 32 reporting European destinations reported growth from the U.S. in 2016.

Iceland was the fastest growing destination for U.S. travelers in 2016, up 71 percent

based on full year data. “This growth was aided by Iceland’s growing importance

as a hub for transatlantic travel,” the report states. “Both Europeans and North Americans have been increasingly breaking up transatlantic trips with some nights in Iceland. In

addition, continued growth in scheduled seats on flights between Iceland and

the US, and also to European destinations will allow continued growth.”

Belgium and Turkey saw fewer U.S. arrivals last year, down 25.6 and 43.1 percent, respectively.

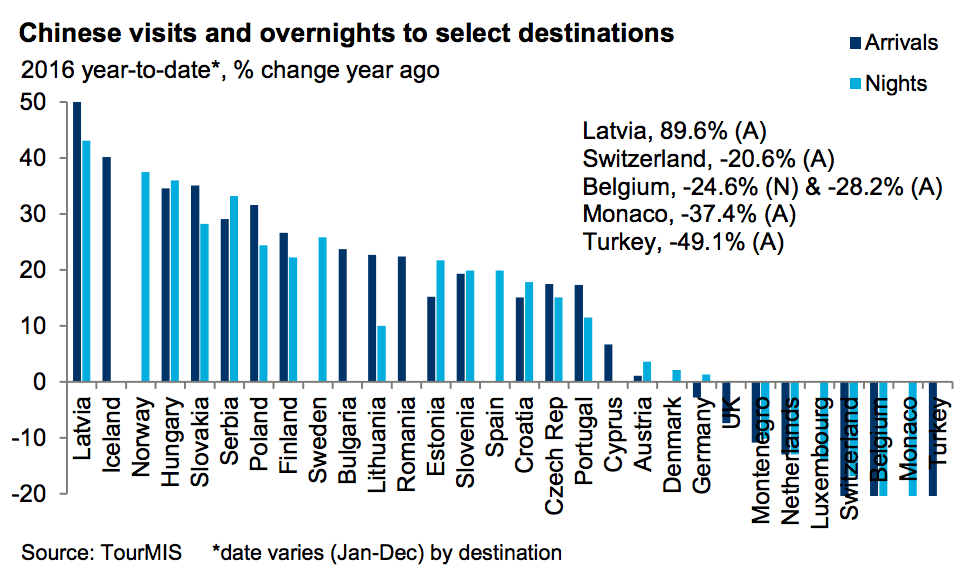

Chart 6: Some 18 of 30 reporting European destinations reported double-digit arrivals growth from China last year with Latvia reporting 89.6 percent growth based on data to September, for example.

But other countries such as the UK, Germany and the Netherlands had fewer Chinese visitors last year than in 2015. “Potential travelers from some markets, and notably from some long-haul Asian markets, seemingly view all European destinations as being equally unsafe,” the report states.

Although Europe has bounced back with Chinese travelers, uncertainty remains. “Tourism Economics estimate that long-haul travel from these markets was increasingly to non-European destinations during the year,” the report states. “Perceptions may be exacerbated by travel itineraries on tours covering multiple countries and a view of the region as a single entity.”

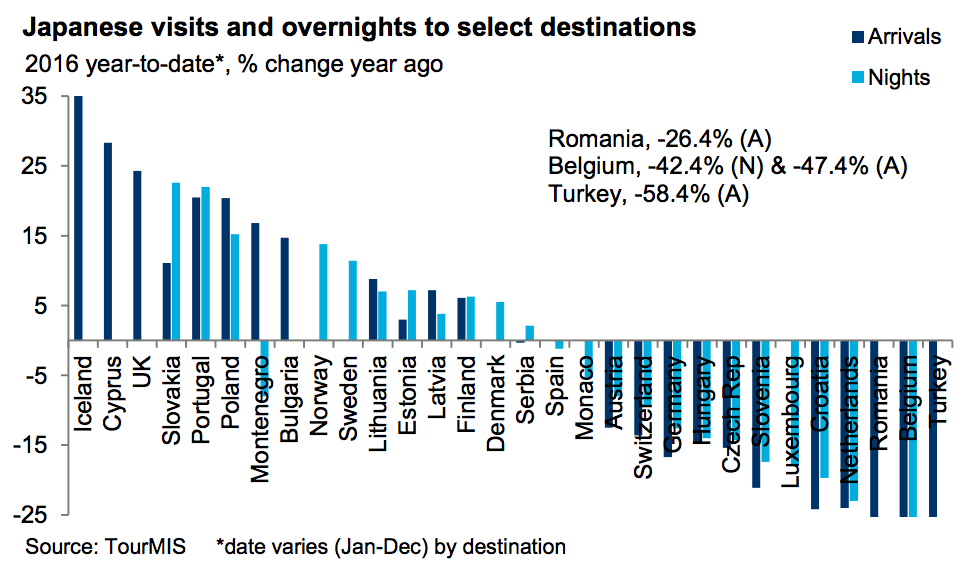

Chart 7: Iceland, the UK, Portugal and Sweden, for example, had double-digit growth in Japanese arrivals last year.

“Some strengthening of the yen in 2016, and notably following the Brexit vote, has increased affordability for Japanese travelers but does not fully offset prior currency depreciation,” the report states. “Japan’s economy has remained subdued over the past few years and this has been evident in outbound tourism performance.”

Source: skift.com